nj property tax relief 2018

Ad Prepare your 2018 state tax 1799. Stay up to date on vaccine information.

Where Your Tax Dollar Was Spent In 2018

Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018.

. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. The average property tax bill in 2018 was 8767 a 77 increase over the 8690 bill. Your benefit payment according to the Budget appropriation is calculated by.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Local Property Tax Forms. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled.

The Homestead Benefit program provides property tax relief to eligible homeowners. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the. COVID-19 is still active.

Property Tax Relief Programs Homestead Benefit. The state of New Jersey is offering a new property tax relief program that is replacing the previous Homestead Benefit program. New Jerseys Property Tax Relief Programs.

Water and Sewer Rules and Policy Manuals. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Based On Circumstances You May Already Qualify For Tax Relief.

Prepare and file 2018 prior year taxes for New Jersey state 1799 and federal Free. New Jersey Tax-Resolution Program. Covid19njgov Call NJPIES Call Center for medical information related to COVID.

Ad See If You Qualify For IRS Fresh Start Program. 100 Free Federal for Old Tax Returns. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

Ad Reduce Your Back Taxes With Our Experts. Civil Union Act Implementation. State Tax Office Website.

The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit. You May Qualify for an IRS Forgiveness Program. Property Tax Relief Forms.

End Your Tax Nightmare Now. Property Tax Relief Forms. If your New Jersey Gross Income is.

New Jersey Property Tax Relief Programs. The amount varies according to the amount of the taxpayers NJ taxable income. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

2018 Third Round Housing Element and Fair Share Plan. Applications for the homeowner benefit are not available on this site for printing. Local Property Tax Relief Programs.

Prior Year Homestead Benefit Calculations. Applications for the homeowner benefit are not available on this site for printing. State Tax Office 75 Veterans Memorial Drive East Suite 103 Somerville NJ 08876.

The Affordable New Jersey Communities. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. We will mail checks to qualified applicants as.

On January 1 2017 the tax rate decreased from 7 to 6875. The filing deadline for the 2018 Homestead Benefit was November 30 2021. Property Tax Relief Programs.

We will mail checks to qualified applicants as. The filing deadline for the 2018 Homestead Benefit was November 30 2021. Free Case Review Begin Online.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Flush With Cash Nj Budget Eyes Property Tax Relief

Nj Property Tax Relief Program Updates Access Wealth

How The Tcja Tax Law Affects Your Personal Finances

How Does The Deduction For State And Local Taxes Work Tax Policy Center

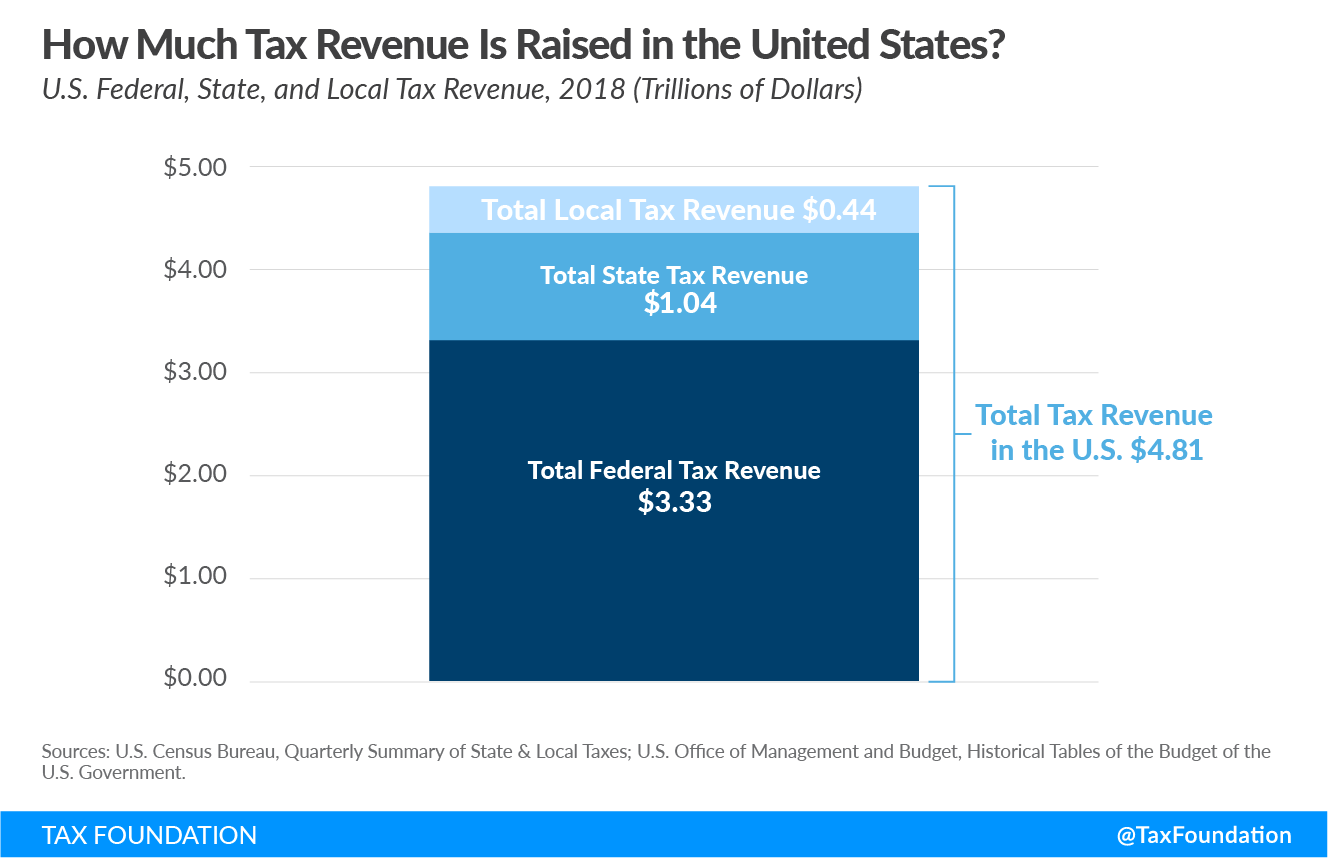

Government Revenue Taxes Are The Price We Pay For Government

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Here S How Trump Law Limiting Your Property Tax Break Hurt Jersey S Middle Class Nj Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Township Of Nutley New Jersey Property Tax Calculator

Uber Drivers Airbnb Hosts Get Tax Tips As Irs Launches New Web Page On Shared Economy Airbnb Host Economy Sharing Economy

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Record High N J Budget With Property Tax Rebates Big Pension Money Tax Holidays Passes Legislature Nj Com

Governor Murphy Highlights Anchor Property Tax Relief Program Wrnj Radio

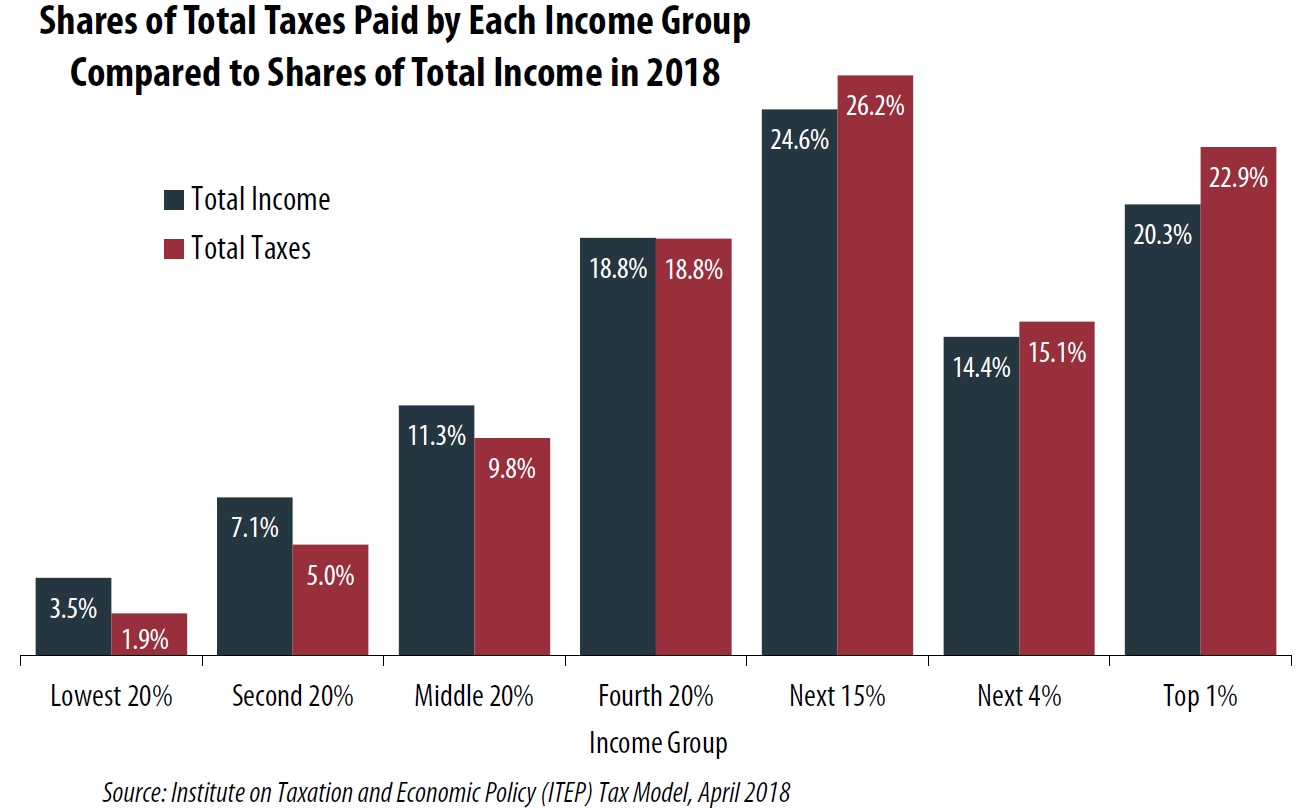

Who Pays Taxes In America In 2018 Itep

Tax Wedge Taxing Wages Details Analysis Tax Foundation

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities